Online reviews are a powerful tool for businesses to understand customer satisfaction, improve services, and build trust. They can drive sales with positive feedback or turn around dissatisfied customers by addressing concerns promptly. For consumers, online reviews help navigate the digital marketplace, especially when comparing financing options. By exploring terms, repayment schedules, and hidden fees, individuals can make informed decisions to avoid high-interest rates and select plans that align with their financial goals and capabilities.

When considering significant purchases, exploring financing options and payment plans is essential. This comprehensive guide delves into the world of financial support, helping you navigate various schemes. From understanding different financing types to leveraging online reviews, this article equips readers with strategies to make informed decisions. Learn how to compare alternatives, gain insights from real-world examples, and discover the power of customer feedback through online reviews in shaping your payment plan choices.

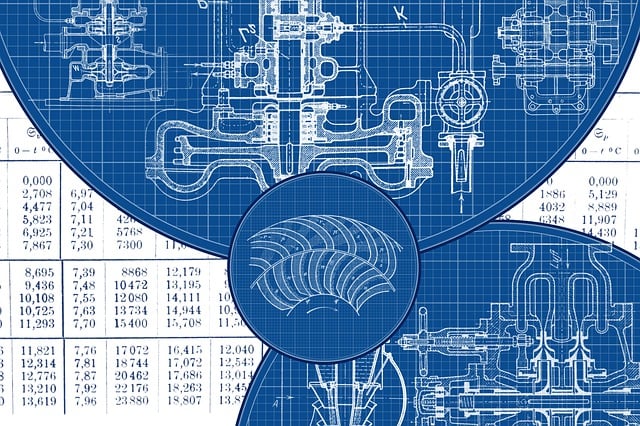

- Understanding Financing Options: A Comprehensive Overview

- The Role of Online Reviews in Payment Plan Decisions

- Strategies for Comparing Financing Alternatives

- Real-World Examples: Success Stories and Lessons Learned

Understanding Financing Options: A Comprehensive Overview

The Role of Online Reviews in Payment Plan Decisions

Strategies for Comparing Financing Alternatives

When comparing financing options, it’s crucial to consider more than just interest rates. Delve into the specifics of each plan, including terms, repayment schedules, and any hidden fees. Online reviews can be a valuable tool; reading experiences from others who have used similar financing can offer insights into potential pitfalls or exceptional customer service.

Look beyond the immediate cost. Evaluate how each financing alternative aligns with your financial goals and budget in the long term. Some plans may offer lower monthly payments but extend the loan period, resulting in paying more in interest over time. Others might provide more flexibility with early repayment options, allowing you to save money if your financial situation improves.

Real-World Examples: Success Stories and Lessons Learned

In today’s digital era, many individuals and businesses have successfully navigated financial constraints by leveraging various financing options and payment plans. Online reviews play a pivotal role in this process, offering insights into the reliability and flexibility of different funding sources. For instance, startups have used crowd-funding platforms to gain initial capital, with positive online reviews highlighting transparent practices and successful product launches. Similarly, established businesses have benefited from line-of-credit loans, which, according to numerous online reviews, provide much-needed liquidity during lean periods.

These success stories underscore the importance of thorough research and understanding financing options. Lessons learned from both triumph and failure are readily available through online reviews, guiding prospective borrowers towards responsible financial decisions. By reading genuine experiences shared by their peers, individuals can avoid common pitfalls, such as high-interest rates or hidden fees, and choose payment plans that align with their financial capabilities and long-term goals.