When evaluating insurance bonding recommendations, prioritize reputable industry sources like trade associations and regulatory bodies for valuable insights grounded in research and experience. Verify referrents' credentials by checking certifications, licenses, online reviews, and affiliations with professional organizations to ensure reliability. Thoroughly research providers by examining bond types, coverage, terms, and customer reviews on platforms like Trustpilot and the Better Business Bureau to select a reputable service aligned with specific needs.

When seeking an insurance bonding provider, turning to trusted sources for recommendations is a prudent step. This article guides you through navigating this crucial process, focusing on three key strategies: assessing industry insights from reputable sources, verifying the credentials and reputations of recommenders, and comparing insurance bonding services and client reviews. By following these steps, you’ll be well-equipped to make an informed decision in the world of insurance bonding.

- Assess Recommendations From Reputable Industry Sources

- Verify Credentials and Reputations of Recommenders

- Compare Insurance Bonding Services Offerings And Reviews

Assess Recommendations From Reputable Industry Sources

When evaluating recommendations for insurance bonding, it’s crucial to assess their source carefully. Reputable industry sources, such as trade associations, regulatory bodies, and respected market analysts, offer valuable insights backed by extensive research and experience. These entities typically have a deep understanding of industry trends, legal requirements, and financial risks associated with insurance bonding. By relying on their recommendations, businesses can make informed decisions that align with best practices.

Moreover, considering advice from established industry leaders helps ensure compliance with evolving regulations and standards. Their guidance often reflects the collective wisdom gained from years of experience in managing complex risk scenarios. This not only protects businesses from potential financial exposure but also fosters a culture of transparency and trust among stakeholders. Ultimately, leveraging insights from these trusted sources can contribute to more robust insurance bonding strategies.

Verify Credentials and Reputations of Recommenders

When considering recommendations, it’s paramount to verify the credentials and reputations of those providing them. This is especially true in sectors like insurance bonding, where financial and legal risks are high. Check if the recommenders have relevant industry certifications or licenses that validate their expertise and knowledge. Online reviews and testimonials from previous clients can also offer insights into their professionalism and reliability. Reputable referrents should have a proven track record of providing accurate and beneficial advice.

Additionally, looking into the background and experience of the people giving recommendations ensures you’re getting advice from qualified individuals. Verify their affiliations with relevant organizations or associations to confirm they stay updated on industry trends and changes in regulations, such as those related to insurance bonding. This meticulous approach helps ensure that the guidance offered aligns with current standards and best practices.

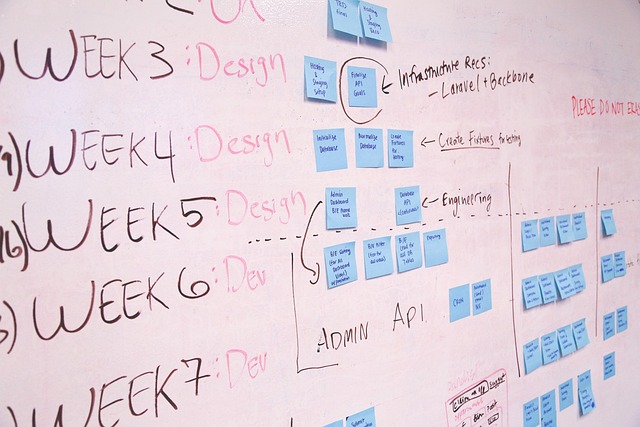

Compare Insurance Bonding Services Offerings And Reviews

When comparing insurance bonding services, start by examining each provider’s offerings and reviews. Look for a variety of bond types – from construction to professional services – to ensure they cater to your specific needs. Check their coverage limits, terms, and conditions to understand what’s included in their policies.

Read customer reviews and testimonials to gauge satisfaction levels. Websites like Trustpilot and Better Business Bureau offer insights into the provider’s reputation, reliability, and claim handling processes. This step is crucial as it allows you to make an informed decision, choosing a service that aligns with your requirements and offers peace of mind.